If you’re living on a tight budget and find yourself barely scraping by from paycheck to paycheck, getting your tax refund might seem like an incredible gift. However, you want to use this gift wisely. While it is natural to want to spend your tax refund immediately, there are better ways to use this money, especially if you are in debt. Of course you might be tempted to use that money to buy your daughter the Christmas gift you couldn’t afford a few months ago, or to upgrade to a better car, but spending the money in this way will only increase your money troubles down the line. Here are my top 3 ways that you can use your tax refund to get out of debt.

- Establish an emergency savings account. If you don’t already have an emergency savings account, it is a good idea to create one. Even if you have significant debt, if you aren’t sure where your tax refund money should go, a good idea is to set up an emergency account and leave the money alone for now. You can establish this account and allow the money to collect interest while you wait until you really need it. Emergencies can occur at any time, and even if you have debt, you should be saving so that if you suddenly need surgery or money to pay your mortgage, you can use the funds in this account.

- Pay off a debt. If you have debt, you can use this money to chip away at it. Do you have a lingering student loan that you can’t seem to get rid of? Is your credit card debt getting out of control? Nobody likes to be in debt, so putting this money toward living a debt free life can give you confidence and help you start focusing on other financial goals. If you have multiple debts, start paying off the one with the most interest first.

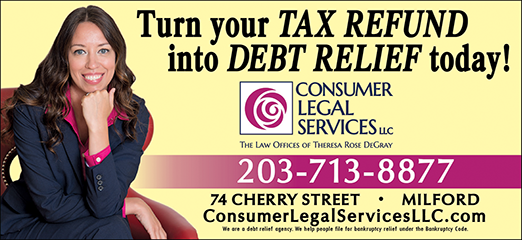

- Use the money to pay for bankruptcy. Is your debt just out of control? Have you been thinking about filing for bankruptcy? When you have a little extra money, it might be the best time to file for bankruptcy. Your tax returns can cover the filing fees and attorney fees. If you’ve been putting off bankruptcy because you didn’t think that you could hire a bankruptcy lawyer, this is your opportunity to get the help you need by using some extra money. Using your tax return to chip away at debt is a good option, but keep in mind that you can also use that money to file for bankruptcy and have all of your debts discharged.

Using your tax refund to its fullest ability will help you improve your financial situation. If you have been considering bankruptcy, now is a good time to do so because you can afford to file and hire a lawyer. If you would like to discuss good ways to use your tax refund with me, I am happy to help. As someone who has filed for bankruptcy and paid off several debts, I can give you some advice about managing your money and how to best pay off your debt. If you think that bankruptcy is the right option for you, you can contact me by clicking here.