After your initial consultation, I will analyze your financial circumstances and perform your Means Test. A Means Test is an assessment used to determine if you qualify to file a Chapter 7 Bankruptcy.

Before 2005 it was easy to file for bankruptcy; virtually anyone could do so. In 2005 Congress enacted the Bankruptcy Abuse Prevention and Consumer Protection Act (BAPCPA)1 and added the Means Test requirement to prevent abuse of the Bankruptcy process. Simply put if you “pass” the means test, you are a qualified candidate and can file a Chapter 7 Bankruptcy Petition. If you “fail” the means Test, you may not file a Chapter 7 Bankruptcy but you may enjoy other alternatives such as a Chapter 13 Bankruptcy.

The Means Test primarily encompasses a two-step analysis:

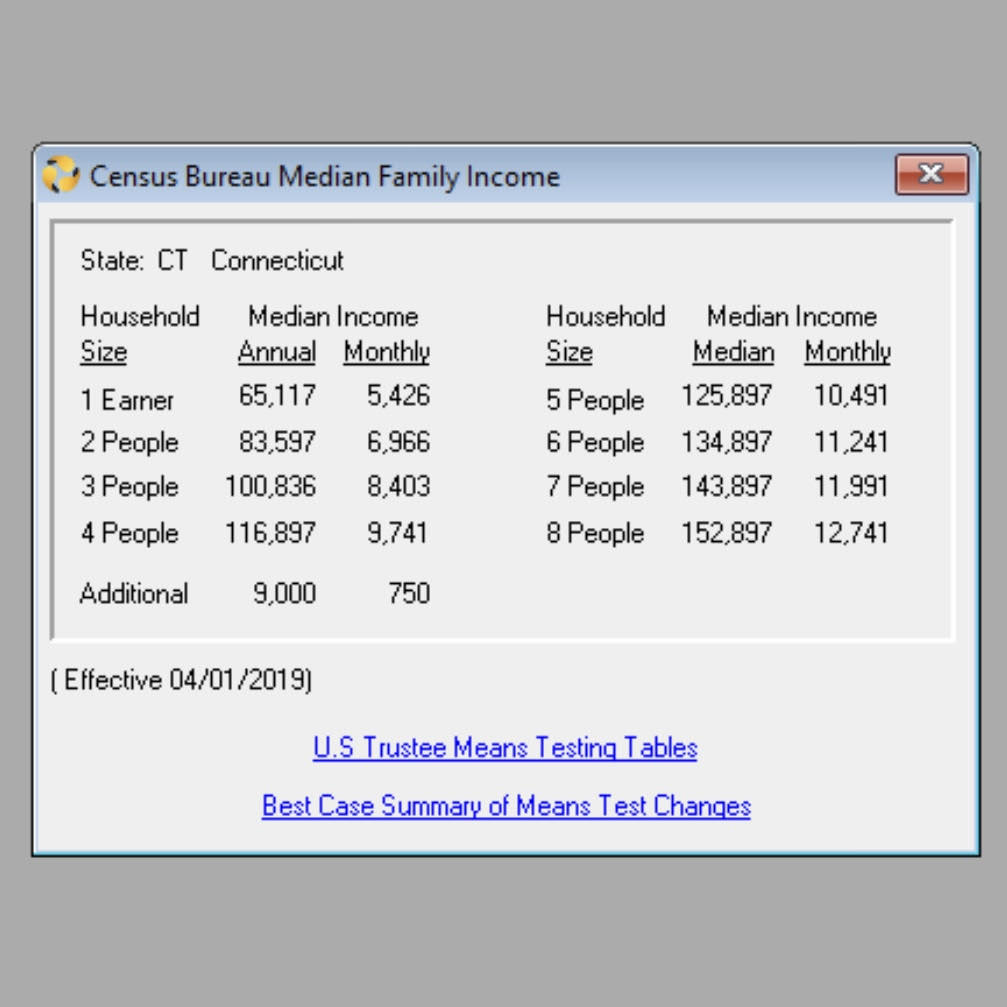

STEP ONE: Your (the “debtor’s”) gross income is calculated on an average over a six month period prior to filing for Bankruptcy. Gross income for means testing purposes includes wages, salary, tips, bonuses, overtime and commissions. It does not include social security benefits. The figure derived from taking the average is than considered the Debtor’s Current Monthly Income which is then compared to the median income for your state and household size. If your current monthly income is less than the median income for your state and household size, than you “pass” the means test and are allowed to file a Chapter 7 Bankruptcy Petition. If, however, your current monthly income is greater than the median income for your state and household size, you may proceed to Step Two.

STEP TWO: If your current monthly income is greater than the median income for your state and household size, there is, in technical terms, a “presumption of abuse.”2 In order to rebut the presumption, or in other terms, to pass the means test by using the second step, the means test’s second section allows you to subtract from your current monthly income certain allowable and deductible expenses.3 These allowed deductions include, but are not limited to, expenses for living (mortgages and property taxes), transportation (car loans and car taxes), health insurance and charitable donations. After the calculations are performed, and the allowable deductions are taken, and if you then have no disposable monthly income available, you will then have passed the Means Test and may file a Chapter 7 Bankruptcy. If, on the other hand, you do have remaining disposable income, you may consider a Chapter 13 Bankruptcy.

The discussion above is an overview of the Means Test in basic terms and is in no way intended as a specific analysis of your personal financial circumstances.

For an analysis of your own financial circumstances, please contact Attorney Theresa Rose DeGray, to schedule your free consultation today!

________________________________

1See: 11 U.S.C. § 707(b)

2See: 11 U.S.C. § 707(b)(2) and 11 U.S.C. § 707(b)(3)

3See: 11 U.S.C. § 707(b)(2)(A)