Have you ever thought about the history of currency? Turns out, bartering was our first form of exchange as humans. Paper money, as we know it today, didn’t come to fruition until the 9th century. In the 17th century checks (or cheques) were first introduced in England. Credit cards are a rather modern invention first appearing for use as “charge accounts” in America around the end of the 19th century.

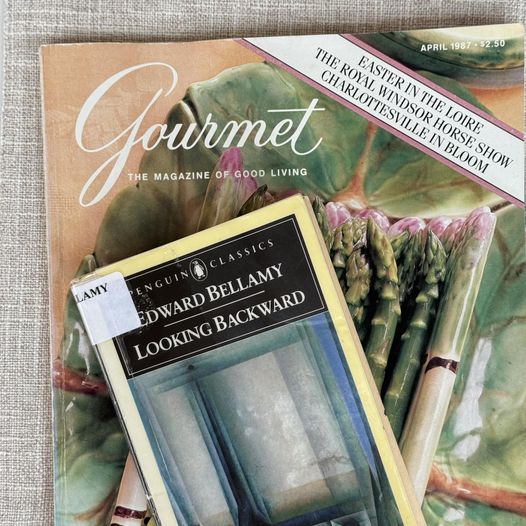

As I was doing research for this article, most sources cited a best-selling, “highly provocative” 1888 utopian novel called Looking Backward 2000-1887, by Edward Bellamy (a fellow life-long New Englander), in which a man falls asleep in 1887 and wakes up in the year 2000. In the story, Mr. Bellamy all but prophesies inventions such as “public storehouses” like Costco, and mentions the term “credit card” multiple times. I was so intrigued, I called the Case Memorial Library to see if I could track down a copy. Surprisingly, they had a 1988 reprint on the shelves. A patron took the liberty of underlining important passages and writing neat little notes throughout the book in pencil. Lightened by the years that have passed, these markings became rather helpful while dissecting such science fiction.

Notwithstanding the heavy, superfluous language, in Chapter IX, Mr. Bellamy’s character Dr. Leete explained the forward thinking idea of how each citizen would be given “his share of the annual product of the nation” annually and purchases would be made against it using a “credit card.” In this situation, it was more like a modern-day debit card. He goes on to explore the idea of needing to spend more than your card would allow and Dr. Lette describes “a limited advance on the next year’s credit.” The notions Mr. Bellamy put forth would have been mind-blowing and ground-breaking all at once to a person living in the 1880’s.

In real life, society started out slowly with the idea of buying on credit with in-store charge accounts introduced in the late 19th and early 20th Centuries.

Charge accounts could only be used at the specific store which issued their own coins (like cards that fit on a keyring) that could be imprinted on a sales slip.

The next iteration of credit cards were similar and called “charga-plates.” They were dog-tag style, metal plates also used for imprinting. Eventually credit cards and charge cards were issued in various forms of plastic and most in a uniform standard size of about 3 inches by two inches. In case you are interested, you can buy collectible metal charga-plates and vintage credit cards on eBay now.

Charge accounts were popular and from that, demand came for a wider general charging (credit) system. As a result, in the 50’s, Diners Club was invented, then came along airline credit cards, and eventually American Express, MasterCard, Visa, etc. followed.

By the 70’s credit cards were more common but women couldn’t’ have one without a male co-signer until the Equal Credit Opportunity Act (ECOA) was passed in 1974. The ECOA made it unlawful to discriminate against applicants on the basis of, among other things, race, religion and sex.

Later on in the 70s, the Fair Debt Collection Practices Act (FDCPA), an amendment of the Consumer Credit Protection Act, was passed to protect consumers from abusive debt collection practices.

The FDCPA prohibits debt collectors from an array of conduct such as contacting consumers who are delinquent on their debts by phone before 8:00 A.M. and after 9:00 P.M. They are also barred from threatening arrest (as we do not have debtors’ prisons) and using profane language in their communications.

Affirmatively, the FDCPA requires debt collectors to clearly identify themselves and state that the communication is from a debt collector, and any information obtained may be used to collect the debt.

The FDCPA is enforced by the Consumer Financial Protection Bureau and consumers who are victims of debt collectors who abuse the FDCPA can sue the collectors in private lawsuits. The only real defense the collectors have is called “bona fide error.” Meaning that it wasn’t intentional. This is held to a preponderance of the evidence standard, or more likely than not.

A few weeks ago we stopped at the English Market in New Haven. They have a ton of vintage knickknacks. Among the settees in the front of the store are old magazines. As I thumbed through the April 1987 edition of Gourmet Magazine, looking for some recipes, I came to an ad for a Chase Manhattan Premier World Visa Card. It even included an application you could rip out and mail in with just a piece of tape holding it together. I cringed at the thought as my mind immediately went to the idea of identity theft. The application requires a social security number and many other pieces of personal identifying information. Oh, how times have changed! Nowadays we have to submit to a two-step authentication to log into many websites and apps such as Venmo or PayPal.

We have come so far that many people (including myself) never carry cash around; and others don’t even carry plastic credit or debit cards anymore. Instead, they use their Apple Wallet. Looking forward (instead of backward, Mr. Bellamy), I wonder what the next iteration of currency will be in my grandchildren’s lives and beyond.