It is very rare that a person is allowed to choose the law that applies to him or her. Bankruptcy in Connecticut is one of the few instances where there is that choice of laws. Let me explain how.

The most common type of Bankruptcy is Chapter 7 which is often referred to as “liquidation bankruptcy.” During a Chapter 7, the filer, called a Debtor, gets to decide between Federal or State exemptions hence making a choice of the law that is applied to their case.

Simply put, exemptions are a set of statutory protections. They protect certain types of property from liquidation. A liquidation bankruptcy is one in which the Bankruptcy Trustee, the person that is assigned to the case to administer the assets, takes control of the Debtor’s property.

Bankruptcy is a full disclosure situation, meaning the debtor must report all assets, all income and all debt. It is the role of the Debtor’s attorney to protect as many assets of the Debtor as possible.

When I go to file a client’s Bankruptcy case it feels like putting together a jigsaw puzzle. Everything must fit into certain parameters prescribed by the Bankruptcy Code. For instance, Debtors are allowed to have certain assets or certain amounts of assets under each scheme of exemptions. If they have too many assets or too much equity in their assets, those assets or that equity could be exposed and the Debtor risks the asset or equity being taken by the Trustee to sell (or “liquidate”) and pay the proceeds to their creditors.

There are many exemptions for specific items such as Real Estate, Vehicles, Jewelry, Fire Arms, Health Aids, Tools of the Trade, etc., and then there is a Wildcard Exemption for nearly anything including cash, in both the State and the Federal Exemption Statutes.

To determine which set of exemptions to use (the choice of law), I usually start the analysis with determining whether the client has a home (or rather equity therein) since that is the biggest “big ticket item” we usually see clients own. If the client has real estate, we ask that the client get a free Comparative Market Analysis from a licensed Real Estate Agent to determine if there is equity in the property. That is done by taking the value of the property and deducting the balance of any and all mortgages, liens or other encumbrances. If the equity is over the Federal Exemption amount of $27,900.00 then we would apply the State Exemptions and then look at the debtors other property to see if the state exemptions protect everything else. If the client is a renter and there is no home equity to consider, then more often than not, Federal Exemptions will be utilized. If the client has too much property that is exposed, it is up to the client to file with that knowledge and understanding that they may lose their property, otherwise, we would not file their case.

Ultimately, in the exemption analysis, there is trade-off at play. In the State Exemption scheme the Homestead Exemption is (now*) $250,000.00 but the State Wildcard is only $1,000.00. Here comes the tradeoff: The Federal Homestead Exemption is only $27,900.00 but the Federal Wildcard is $15,000.00. So depending on what you need to protect, you must make a choice.

*The Homestead exemption was just raised recently. It was originally created in 1993 and at that time was set to $75,000.00. In the 30 years since, we have seen a lot of changes in the housing market. Owing to this fact, in 2022, the State Legislature changed it from $75,000.00 to $250,000.00. However, they failed to add any language into the statute to assist bankruptcy filers in knowing if it was to be applied retroactively or prospectively. Meaning, did it apply to debts that were incurred prior to 2022 or only those incurred after its enactment.

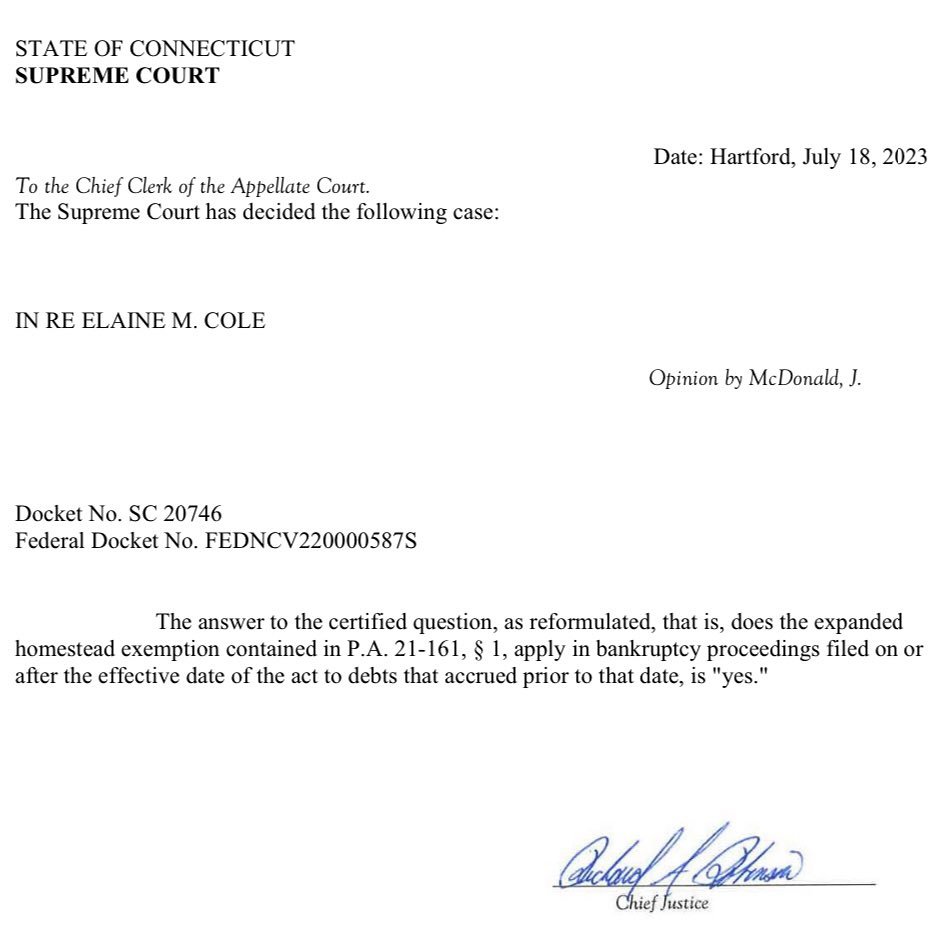

Some attorneys (not me) filed cases for clients who had equity in excess of $75,000.00 under the new law immediately after it went into effect on October 1, 2022. In one case, In Re Elaine M. Cole, the Trustee objected to the use of the new Homestead Exemption, arguing that it was to be applied only to debts incurred after October 1, 2022. The Bankruptcy Court overruled the Trustee’s objection and the Trustee appealed to the United States District Court, which certified the question to the Connecticut Supreme Court.

The Debtors Bar (myself included) waited impatiently for a decision and on one beautiful day in July 2023, we got the unequivocal answer when Connecticut Supreme Court Chief Justice Andrew J. McDonald wrote in the rescript: “The answer to the certified question, as reformulated, that is, does the expanded homestead exemption contained in P.A. 21-161, § 1, apply in bankruptcy proceedings filed on or after the effective date of the act to debts that accrued prior to that date, is “yes.”

YES!

This is huge news in the Bankruptcy World. It is a victory for the Debtors’ Bar and Debtors in general. It means more people can seek debt relief and protection from their creditors while keeping their homes. The attorney that argued the Cole case was Jenna Sternberg and in my opinion, she is a hero.